Have you ever bought a car from a dealer? New car, used car (excuse me: preowned vehicle), it doesn’t matter. Either way, you’re about to sign page after page after page of dense paperwork you’re not really going to read.

And if you do read it, says David Maxfield, consumer protection lawyer in Columbia, professor of consumer law at the University of South Carolina, and three-time chairman of the Consumer Law section of the South Carolina Bar, you’re not really going to understand it anyway.

“In car leases, there's something called the Consumer Leasing Act … that says they have to tell you how they're going to calculate your early termination penalty,” Maxfield says. “And it's got to be clear and reasonable."

But he cites a practice by a major financier for which “clear and reasonable” was a real stretch.

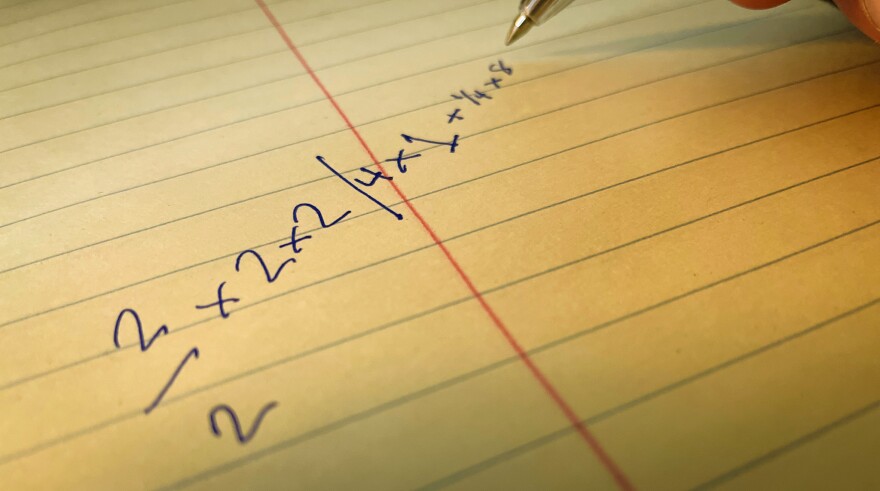

“Instead of saying, ‘We're going to multiply X times four,’” he says, “they would say, ‘We're going to multiply two over two times two times two.’ They were … making the equation or the calculation intentionally much more difficult to the point where it was mystifying.”

And that’s how people with assets end up in deep debt, Maxfield says. Because when you are fortunate enough to have a savings account and good credit, lenders of all kinds see your money as a pizza they really want a slice of.

In fact, the worst thing you can be to a high-dollar lender like a car financier or a mortgage lender or your bank (or credit union), Maxfield says, is content.

“What [as a lender] am I going to sell you,” Maxfield asks, if you're not continually adding to your debt portfolio?

Let’s say you like your house. You don’t want to sell it and you don’t feel the need to do anything to it. That would mean you’re not a customer to a lender, because you have no reason to borrow against the value of your (likely) largest asset.

So lenders need to change your perspective if they want you as a customer. This, says Maxfield, is where lenders start marketing to you to, say, refinance your mortgage.

“If I'm going to make money off you in some way,” Maxfield says, “one way I could do that would be to refinance you [to] get you a better rate. You get some of that equity out [of your home] and do something with it. Maybe you build a swimming pool. Or pay off your credit card debt.”

Consumer Affairs.com last summer found that 36 percent of homeowners nationwide report credit card debts specifically due to general housing expenses. Which might just make refinancing extra tempting to consider.

But in South Carolina, be aware that real estate values are escalating rapidly in all the metros. Also be aware that a 2021 report from the credit bureau Experian found that South Carolina is one of only a few states where median mortgage debt is more than the median home value. And Experian reported in 2022 that the average mortgage in South Carolina went up by almost 16 percent between 2017 and 2021.

Meanwhile, from 2017 to 2020, average credit scores in the U.S. improved marginally (South Carolina’s average credit score in 2022 was 696, according to Business Insider), and the median salary in in South Carolina went up 13 percent, according to data from the state Revenue and Fiscal Affairs Office.